Absa

Bank Tanzania has started the year 2022 positively by recording profit

after tax (PAT) of TZS 5.2 billion which is 155% higher than the amount

recorded in the same period 2021. The improved performance was driven by

good performance in transaction banking, FX Income and net interest

income following the improving economy from the pandemic effects

together with launching of mobile lending which has positively impacted

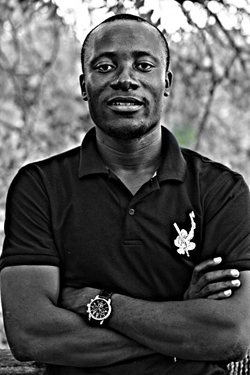

interest income, the bank’s Managing Director Abdi Mohamed has revealed.

“The profit before tax (PBT) also grew significantly by 150% year on year from 2.96 billion in the first quarter of 2021 to TZS 7.38 billion this year. This was mainly contributed by the 33% growth in NII driven by the mobile lending and the notable improvement on the income from the government securities on the back of the increased volumes”, said Abdi Mohamed yesterday

He also commented that the Fees and commission and FX Income improved by 31% and 40% respectively year on year. The impressive improvement by organic growth following improving economic activities that has seen growing volumes of transactions. The bank continues to be competitive in pricing its products and services and the ensure the customers get the best quality of services.

Absa Finance Director (CFO) Obedi Laiser said, “the net customers loans improved by 34% year on year and 20% from the previous quarter thanks to the impressive impact of the mobile lending drive. The bank continued to sell and grow its mobile lending product in partnership with Tigo Tanzania that has reached thousands of customers and assist them to access financial services more conveniently and improve their lives and wellbeing. The growth in customers’ loans was also boosted by the increased utilization in overdraft facilities as customers continued to finance their growing business needs”.

The customers’ deposits improved 4% year on year and 8% from the previous quarter with growth obtained in all segments. The bank has a network of delivery channels and talented customers’ service team that provide our esteemed customers with best value proposition. Our prices on the deposits continue to remain competitive, according to Laiser.

Total capital position of the bank grew by a decent 14.52% year on year to TZS 153 billion largely contributed by the retained profit which was reinvested into the capital of the bank. Total Capital of the bank increased by TZS 5.15 billion during the year adding more capital resources which are deployed in expanding Bank’s lending capabilities to serve our customers better. The bank continues to have a strong capital position and operates well above the regulatory and internal capital requirements, said CFO Obedi Laiser.

“The profit before tax (PBT) also grew significantly by 150% year on year from 2.96 billion in the first quarter of 2021 to TZS 7.38 billion this year. This was mainly contributed by the 33% growth in NII driven by the mobile lending and the notable improvement on the income from the government securities on the back of the increased volumes”, said Abdi Mohamed yesterday

He also commented that the Fees and commission and FX Income improved by 31% and 40% respectively year on year. The impressive improvement by organic growth following improving economic activities that has seen growing volumes of transactions. The bank continues to be competitive in pricing its products and services and the ensure the customers get the best quality of services.

Absa Finance Director (CFO) Obedi Laiser said, “the net customers loans improved by 34% year on year and 20% from the previous quarter thanks to the impressive impact of the mobile lending drive. The bank continued to sell and grow its mobile lending product in partnership with Tigo Tanzania that has reached thousands of customers and assist them to access financial services more conveniently and improve their lives and wellbeing. The growth in customers’ loans was also boosted by the increased utilization in overdraft facilities as customers continued to finance their growing business needs”.

The customers’ deposits improved 4% year on year and 8% from the previous quarter with growth obtained in all segments. The bank has a network of delivery channels and talented customers’ service team that provide our esteemed customers with best value proposition. Our prices on the deposits continue to remain competitive, according to Laiser.

Total capital position of the bank grew by a decent 14.52% year on year to TZS 153 billion largely contributed by the retained profit which was reinvested into the capital of the bank. Total Capital of the bank increased by TZS 5.15 billion during the year adding more capital resources which are deployed in expanding Bank’s lending capabilities to serve our customers better. The bank continues to have a strong capital position and operates well above the regulatory and internal capital requirements, said CFO Obedi Laiser.

No comments:

Post a Comment