Dar es Salaam, Thursday 31st October 2019 – Tanzania's leading commercial Bank, CRDB Bank PLC, today announces a 76% jump in its net profit for the year ending September 2019.

During the period, CRDB Bank Group reported a net profit of TZS 92.16 billion from its operations, up from TZS 52.25 billion recorded in the same period in 2018.

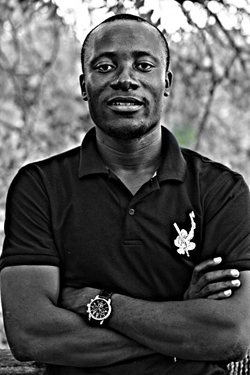

CEO and Managing Director, Abdulmajid Nsekela attributes the impressive performance to dedicated and committed staffs, responsible lending that led to improved loan quality and loan repayments, growth of CRDB Wakala business and Trade Finance through guarantees.

“Our focus on operational efficiency and sales optimization is paying off. We have embarked on the digitalization journey while adhering to good governance, reduce operational costs, and improve our service delivery. As you can see, our earnings from credit books, trade finance, and foreign currency dealings have significantly increased, showing our commitment to serving each segment in the market," says Nsekela.

Nsekela affirms that the Bank's continued pursuit for business excellence portends even higher financial performance in the last quarter of the year. "We are focusing on the customer, and this means that we are re-engineering our products and services to respond to the changing needs in the marketplace, we are optimistic about our targets, come end of the year," he quips.

The CEO says the Bank has instituted internal reforms that are aimed at improving service delivery and optimizing processes for enhanced customer experience. "We have reviewed critical areas of our operations and deployed a new business model that taps into the

Bank's greatest strengths, while taking advantage of the opportunities in the market,our philosophy still stands at 30/70 where the first stands for back-office dealings, and later for business solicitation and relationship management” the CEO explains.

The Bank - together with its subsidiaries - continued to maintain a healthy balance sheet with Group total assets appreciating by 5% to reach TZS 6.2 trillion up from TZS 5.9 trillion reported in September 2018.

The Group Loan portfolio witnessed a slight positive change to close at TZS 3.25 trillion in the third Quarter of this year, representing an increase of 2.5% from TZS 3.17 trillion reported in the Second quarterquarter, 2019.

“Our total customer deposits increased by 7% to TZS 4.8 trillion, up from TZS 4.5 trillion reported in the third quarter of 2018, while Net Interest Income increased by 22% year on year to reach TZS 389.66 billion from TZS319.09 billion reported in September 2018," says Nsekela.

Nsekela notes that CRDB Bank Group continues to command a 22% market share of industry deposits, owing to its robust network of 240 branches, 551 ATMs, over 2,400 Point of Sales (POS) terminals.

CRDB Wakala agents increased by 7,260 years on year to reach 11,612 by the end of September 2019, who spread across the country.

The Bank’s MD further attributes the Bank’s sustained performance to a robust digital banking proposition through the SimBanking and SimAccount platforms, which continue to provide unrivaled convenience. The Bank also has reliable Internet banking services.

Summary of Key Highlights for the quarter ended September 30th, 2019:

• Loans and advances grew by 6% to reach TZS 3.25 trillion (Q3 2018: TZS 3.08 trillion)

• Net Interest Income increased by 9% to reach TZS 131.86 billion (Q3 2018: TZS 121.28 billion)

• Operating profit grew by 39% to reach TZS 45.09 billion (Q3 2018: TZS 32.37billion)

• Profit for the quarterquarter(after-tax) grew by 36% to reach TZS 31.08 billion (Q3 2018: TZS 22.92 billion).

No comments:

Post a Comment